Customized Tax Accounting Packages For Your Business Needs

How it Works

Maximize your tax savings and ensure compliance with our expertly crafted tax accounting packages. Choose the perfect package to suit your business needs, or contact us for a custom solution.

We offer three comprehensive packages to meet the diverse needs of our clients. Each package is designed to provide value and peace of mind, with services that grow alongside your business.

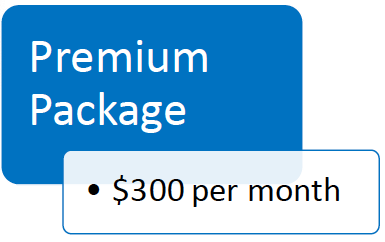

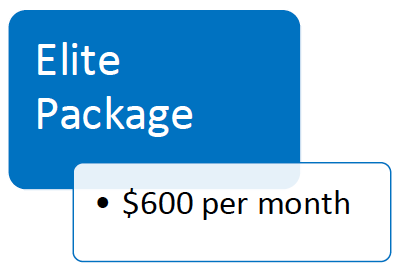

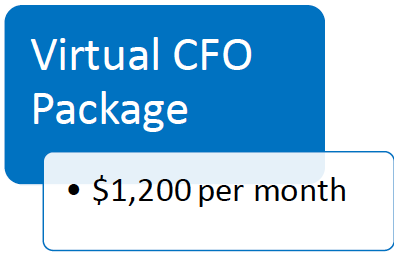

Bundle your services to get more affordable pricing with one of our packages

Previous slide

Next slide

Why Choose Customized Packages?

- Customized Solutions: Tailored packages to meet your specific business needs.

- Personalized Service: Dedicated professionals who understand your business.

- Proactive Approach: We help you plan and save on taxes, not just file them.

Contact us today to discuss which package best fits your business needs and let’s achieve financial success together!

Our Packages Detail

- Classification and tracking of transactions

- Monthly bank and credit card reconciliations

- Quarterly financial statements

- Monthly check-in

- Accounting questions answered

- Financials ready for tax filing (sent to you and/or EA/CPA)

- 1099 reporting

- Quarterly Expense Analysis

- Monthly Journal Entries

- Monthly Depreciation & Amortization

- IRS Representation (ADD ON)

- Payroll (ADD ON)

- Performing due diligence and valuation on business acquisitions (ADD ON)

- Everything in Premium Package

- Yearly Board level reports

- Quarterly tax strategy and planning

- Unlimited tax questions and research

- Business tax filing

- Included personal tax filing for up to two owners

- Business License Renewals

- Monthly/Quarterly/Yearly Sales Tax reporting

- IRS Representation (ADD ON)

- Payroll (ADD ON)

- Performing due diligence and valuation on business acquisitions (ADD ON)

- Everything in Elite Package

- Robust financial reporting and scenario analysis

- Development and tracking of KPIs

- Cash flow optimization, growth strategy, profitability analysis

- Forecasting cash, revenue, expenses and profit

- Annual budgeting

- Monthly budget vs. actual analysis

- Maintaining relationships with banks, lenders, and investors

- Analyzing customer acquisition costs and lifetime values

- IRS Representation (ADD ON)

- Payroll (ADD ON)

- Performing due diligence and valuation on business acquisitions (ADD ON)

Lets Get Started

Ready to get started or have questions? Click the link below to schedule a complimentary consultation with one of our experts. We’ll help you find the perfect tax accounting solution for your business.

Note

*Prices listed are “Starting at” and depend on the size of the engagement

**We are committed to delivering exceptional value. If you don’t feel you’re getting the value you expect, we offer a money-back guarantee. Your satisfaction is our top priority.